Calculation of Contribution Rates Regulations, 2021: SOR/2021-5

Canada Gazette, Part II, Volume 155, Number 4

Registration

SOR/2021-5 February 1, 2021

CANADA PENSION PLAN

P.C. 2021-22 January 29, 2021

Whereas, pursuant to subsection 115(1.3) footnote a of the Canada Pension Plan footnote b, the lieutenant governor in council of each of at least two thirds of the included provinces, having in the aggregate not less than two thirds of the population of all the included provinces, has signified the consent of that province to the annexed Calculation of Contribution Rates Regulations, 2021;

Therefore, His Excellency the Administrator of the Government of Canada in Council, on the recommendation of the Minister of Finance, pursuant to paragraph 101(1)(d.1) footnote c of the Canada Pension Plan footnote b, makes the annexed Calculation of Contribution Rates Regulations, 2021.

Calculation of Contribution Rates Regulations, 2021

Interpretation

Definitions

1 The following definitions apply in these Regulations.

- Act

- means the Canada Pension Plan. (Loi)

- additional contribution rate ratio

- means the ratio — rounded to the nearest whole number or, if equidistant from two whole numbers, to the higher whole number — of the percentage specified in paragraph 46(1)(c) of the Act to the percentage specified in paragraph 46(1)(b) of the Act. (rapport du taux de cotisation supplémentaire)

- contributory earnings

- means the contributory salary and wages and the contributory self-employed earnings referred to in sections 12 and 13, respectively, of the Act. (gains cotisables)

- increased or new benefits

- means the increased or new benefits referred to in paragraph 113.1(4)(e) of the Act. (accroissement ou établissement de prestations)

- review period

- means any three-year period for which the Chief Actuary prepares a report for the purpose of subsection 115(1) of the Act. (période d'examen)

Calculation of Contribution Rates

Base contribution rate

2 For the purpose of subparagraph 115(1.1)(c)(i) of the Act, the contribution rate is the smallest multiple of 0.0001 percentage points that results in a projected ratio of assets to expenditures for the 60th year after the review period that is not lower than the projected ratio of assets to expenditures for the 10th year after the review period, with those ratios being determined by the formula

- (A − B) / (C − D)

- where

- A

- is the projected value on December 31 of that year of all assets of the base Canada Pension Plan;

- B

- is the projected value on December 31 of that year of all assets of the base Canada Pension Plan in respect of any increased or new benefits that result in a contribution rate calculated under section 3 that exceeds zero;

- C

- is the projected amounts charged to the Canada Pension Plan Account under subsection 108(3) of the Act for the year following that year; and

- D

- is the projected amounts charged to the Canada Pension Plan Account under subsection 108(3) of the Act for the year following that year in respect of any increased or new benefits that result in a contribution rate calculated under section 3 that exceeds zero.

Base contribution rate — increased or new benefits

3 (1) For the purpose of subparagraph 115(1.1)(c)(ii) of the Act, the contribution rate with respect to any increased or new benefits is equal to the permanent increase in the contribution rate plus, if applicable, the temporary increase in that rate.

Permanent increase

(2) The permanent increase in the contribution rate is the smallest multiple of 0.0001 percentage points that results in the following formula being satisfied:

- A + B = C

- where

- A

- is the projected value of all assets of the base Canada Pension Plan in respect of the increased or new benefits that are based on the contributory earnings for each year starting with the year in which the increased or new benefits come into effect;

- B

- is the present value of contributions to be made as a result of the permanent increase in the contribution rate; and

- C

- is the present value of the projected extra costs of the increased or new benefits that are based on the contributory earnings for each year starting with the year in which the increased or new benefits come into effect.

Temporary increase

(3) The temporary increase in the contribution rate applies for a number of years that is consistent with common actuarial practice and is the smallest multiple of 0.0001 percentage points that results in the following formula being satisfied:

- A + B = C

- where

- A

- is the projected value of all assets of the base Canada Pension Plan in respect of the increased or new benefits that are based on the contributory earnings for each year before the year in which the increased or new benefits come into effect;

- B

- is the present value of contributions to be made as a result of the temporary increase in the contribution rate; and

- C

- is the present value of the projected extra costs of the increased or new benefits that are based on the contributory earnings for each year before the year in which the increased or new benefits come into effect.

De minimis

(4) If the contribution rate calculated under subsection (1) for the first year after the review period or, if later, the year in which the increased or new benefits come into effect is less than 0.02 percentage points, without regard to section 7, the contribution rate for that year and all subsequent years is deemed to equal zero.

Additional contribution rates

4 (1) For the purpose of subparagraphs 115(1.1)(d)(i) and (e)(i) of the Act, the first additional contribution rate and the second additional contribution rate are the smallest multiples of 0.0001 percentage points that result in

- (a) the second additional contribution rate being equal to the first additional contribution rate multiplied by the additional contribution rate ratio;

- (b) the present value, as at the date referred to in subsection 115(1) of the Act, of the projected expenditures of the additional Canada Pension Plan, determined without taking into account any increased or new benefits that are based on the contributory earnings for each year starting with the year in which the increased or new benefits come into effect and any increased or new benefits that result in a contribution rate increase under subsections 5(3) and (4), being less than or equal to the sum of

- (i) the present value, as at the same date, of the projected contributions under the additional Canada Pension Plan, determined without taking into account those increased or new benefits, and

- (ii) the projected value, as at the same date, of all assets of the additional Canada Pension Plan, determined without taking into account those increased or new benefits; and

- (c) the projected ratio of assets to expenditures for the 60th year after the review period being no lower than the projected ratio of assets to expenditures for the 50th year after the review period, with those ratios being determined by the formula

- (A − B) / (C − D)

- where

- A

- is the projected value on December 31 of that year of all assets of the additional Canada Pension Plan;

- B

- is the projected value on December 31 of that year of all assets of the additional Canada Pension Plan in respect of any increased or new benefits that result in contribution rates calculated under section 5 that exceed zero;

- C

- is the projected amounts charged to the Additional Canada Pension Plan Account under subsection 108.2(3) of the Act for the year following that year; and

- D

- is the projected amounts charged to the Additional Canada Pension Plan Account under subsection 108.2(3) of the Act for the year following that year in respect of any increased or new benefits that result in contribution rates calculated under section 5 that exceed zero.

Review period ending before 2038

(2) For the purpose of paragraph (1)(c), if the 60th year after the review period is earlier than 2098, it is deemed to be 2098 and the 50th year after the review period is deemed to be 2088.

Exception — rates for 2022 and 2023

(3) Despite subsection (1), the first additional contribution rate for 2022 is equal to the first additional contribution rate calculated for 2024 multiplied by 0.75, the first additional contribution rate for 2023 is equal to the first additional contribution rate calculated for 2024 and the second additional contribution rate for 2022 and 2023 is equal to zero.

Additional contribution rates — increased or new benefits

5 (1) For the purpose of subparagraphs 115(1.1)(d)(ii) and (e)(ii) of the Act, the first additional contribution rate and the second additional contribution rate with respect to any increased or new benefits are equal, respectively, to the permanent increase in the first additional contribution rate plus, if applicable, the temporary increase in that rate and to the permanent increase in the second additional contribution rate plus, if applicable, the temporary increase in that rate.

Permanent increases

(2) The permanent increases in the first additional contribution rate and the second additional contribution rate are equal, respectively, to the difference obtained by subtracting the first additional contribution rate calculated under section 4 from the first additional contribution rate that would be calculated under that section if the following variations applied, and to the difference obtained by subtracting the second additional contribution rate calculated under section 4 from the second additional contribution rate that would be calculated under that section if those variations applied:

- (a) the present value of projected expenditures and contributions and the projected value of assets referred to in paragraph 4(1)(b) are to be determined without taking into account any increased or new benefits that result in a contribution rate increase under subsections (3) and (4);

- (b) the description of B in paragraph 4(1)(c) is limited to the projected value of assets of the additional Canada Pension Plan in respect of any increased or new benefits that result in a contribution rate increase under subsections (3) and (4); and

- (c) the description of D in paragraph 4(1)(c) is limited to the projected amounts charged to the Additional Canada Pension Plan Account under subsection 108.2(3) of the Act in respect of any increased or new benefits that result in a contribution rate increase under subsections (3) and (4).

Temporary increases

(3) Subject to subsection (4), the temporary increases in the first additional contribution rate and the second additional contribution rate apply for a number of years that is consistent with common actuarial practice and are the smallest multiples of 0.0001 percentage points that result in

- (a) the temporary increase in the second additional contribution rate being equal to the temporary increase in the first additional contribution rate multiplied by the additional contribution rate ratio; and

- (b) the following formula being satisfied:

- A + B = C

- where

- A

- is the projected value of all assets of the additional Canada Pension Plan in respect of the increased or new benefits that are based on the contributory earnings for each year before the year in which the increased or new benefits come into effect;

- B

- is the present value of contributions to be made as a result of the temporary increases in the first additional contribution rate and the second additional contribution rate; and

- C

- is the present value of the projected extra costs of the increased or new benefits that are based on the contributory earnings for each year before the year in which the increased or new benefits come into effect.

De minimis

(4) There is no temporary increase in the first additional contribution rate or the second additional contribution rate if the increase in the first additional contribution rate calculated under subsection (3) is less than 0.02 percentage points.

Exception — rates for 2022 and 2023

(5) Despite subsection (1), the first additional contribution rate for 2022 is equal to the first additional contribution rate calculated for 2024 multiplied by 0.75, the first additional contribution rate for 2023 is equal to the first additional contribution rate calculated for 2024 and the second additional contribution rate for 2022 and 2023 is equal to zero.

Projected and present values

6 The projected and present values referred to in subsections 3(2) and (3) and 5(2) and (3) are to be determined as at January 1 of the year after the review period or, if later, the day on which the increased or new benefits come into effect.

Rounding

7 If a contribution rate calculated under section 2 or subsection 3(1), 4(1) or 5(1) is not a multiple of 0.01 percentage points, it is to be rounded to the nearest multiple of 0.01 or, if it is equidistant from the two multiples, to the higher multiple.

Repeal

8 The Calculation of Contribution Rates Regulations, 2007 footnote 1 are repealed.

Coming into Force

Registration

9 These Regulations come into force on the day on which they are registered.

REGULATORY IMPACT ANALYSIS STATEMENT

(This statement is not part of the regulations.)

Issues

A stronger Canada Pension Plan (CPP) is now a reality with the coming into force of Bill C-26, An Act to amend the Canada Pension Plan, the Canada Pension Plan Investment Board Act and the Income Tax Act, on March 3, 2017. The CPP enhancement increases income replacement under the plan and raises the maximum amount of earnings covered by the CPP.

A framework is also required to ensure that the enhanced portion of the plan is appropriately funded over time. The Calculation of Contribution Rates Regulations, 2021 and the Additional Canada Pension Plan Sustainability Regulations (the regulations) provide this necessary framework, consistent with the full-funding principle underpinning the CPP enhancement.

Background

The CPP is a mandatory public pension plan that provides a basic level of earnings replacement for workers throughout Canada, except in Quebec where the Quebec Pension Plan (QPP) provides similar benefits.

Base CPP

The base CPP retirement benefit replaces 25% of career average earnings up to a maximum level of eligible earnings (year's maximum pensionable earnings or YMPE), which approximates the average Canadian wage ($58,700 in 2020). Earnings over an entire career, with certain exclusions, are taken into account when calculating benefits. A full CPP retirement benefit is available at age 65; however, it can be taken up on an actuarially adjusted basis with a permanent reduction as early as age 60, or with a permanent increase as late as age 70. Benefits are also provided for workers who become disabled and for spouses of contributors who pass away.

The base CPP is funded by contributions equalling 9.9% of earnings as well as by investment income. The contribution rate is split evenly between employers and employees, with the self-employed paying both shares.

The CPP is a shared responsibility, with the Canadian federal government and the 10 provincial governments serving as joint stewards of the plan. Federal and provincial ministers of finance formally review the CPP every three years and determine whether changes are required to benefits and/or contributions. As part of this triennial review, the Chief Actuary of Canada prepares a report on the CPP's financial state. This report, which is tabled in Parliament, launches the triennial review and provides context for the review by ministers of finance. Major changes to the federal legislation governing the CPP require the formal consent of the Parliament of Canada and at least 7 provinces representing two thirds of the population of the 10 provinces.

In the latest report as at December 31, 2018, the Chief Actuary concluded that the base CPP is sustainable at its current benefit and contribution levels across a 75-year projected horizon. CPP legislation also requires the Chief Actuary to calculate the minimum contribution rate for the base CPP, which is the lowest rate sufficient to financially sustain the base portion of the plan over the long term without further increases. In the latest report (30th Actuarial Report on the CPP), the minimum contribution rate for the base CPP is 9.75% for years 2022 to 2033 and 9.72% for year 2034 and thereafter. The minimum contribution rate for the base CPP is calculated in accordance with the methodology in the Calculation of Contribution Rates Regulations, 2007.

The CPP legislation also details the circumstances in which the base CPP is considered to be in an unsustainable position and the automatic measures that would be taken to remedy a deficit in the event that Canada's ministers of finance are unable to reach a consensus.

CPP enhancement (or additional CPP)

Canada's federal and provincial ministers of finance agreed in June 2016 to enhance the CPP in response to growing concerns that young Canadians face different, and potentially more difficult, challenges in saving for retirement. The agreement, legislated under Bill C-26, increases the maximum level of earnings replacement provided by the CPP from 25% of eligible earnings to 33.33%, and extends the range of eligible earnings by 14% (i.e. if it were in place in 2020, this would extend eligible earnings from $58,700 to $66,900). Plan members will also need to contribute over the full 40-year accrual period to receive full benefits, although partial benefits will be available sooner based on the number of contributing years. As a result, young Canadians, who face the most uncertain savings prospects, will earn the largest benefit. These changes will increase the maximum CPP retirement pension over time by about 50%. Benefits will also be increased for workers who become disabled and for the spouses of contributors who pass away. footnote 2

To pay for the additional benefits, contribution rates are increasing gradually over a seven-year period, starting in 2019:

- a contribution rate on earnings below the YMPE (the first additional contribution rate) is being phased in over five years and will be set at 2% from 2023 onward;

- beginning in 2024, a separate contribution rate of 8% will be implemented on earnings between the YMPE and a new upper earnings limit (the second additional contribution rate); and

- the new upper earnings limit will be phased in over two years, extending the earnings range by an additional 14%.

Canada's Chief Actuary has confirmed this is sufficient to ensure the sustainability of the CPP enhancement for at least 75 years. CPP legislation also requires the Chief Actuary to calculate the minimum contribution rates for the CPP enhancement. In the latest report (30th Actuarial Report on the CPP), the additional minimum contribution rates for the CPP enhancement are 1.98% over the base earnings range (first additional minimum contribution rate or FAMCR) and 7.92% over the additional earnings range (second additional minimum contribution rate or SAMCR).

CPP legislation provides authority to the Minister of Finance for the development of regulations to determine the actuarial methodology for the calculation of the enhancement's minimum contribution rates, as well as the default mechanisms to bring it back to sustainability in the event it is deemed to be outside prudent parameters and ministers of finance are unable to reach consensus.

New financing model

The base CPP was established in 1966 as a pay-as-you-go pension with a small contingency reserve, funded through a modest 3.6% of contributory earnings. Due to demographic and economic changes, by 1995 the Chief Actuary of Canada estimated that the contributory rate would have to increase to over 14% by 2030. In 1997, federal and provincial governments agreed to

- reduce the growth rate of benefits;

- increase the contribution rate to 9.9% by 2003 and remain at this rate indefinitely; and

- use the accumulated surplus, and associated investment returns, to build a more sizeable contingency reserve to be drawn down as the baby boom generation retired.

To maximize investment returns without undue risk of loss, federal and provincial governments created the Canada Pension Plan Investment Board (CPPIB). In addition, the legislation governing the CPP was changed to require that any new enhancement to CPP benefits be fully funded. This requirement was put in place to ensure that the CPP remains financially sustainable going forward.

In 2019, benefits payable under the base CPP were entirely covered by contributions of current workers, with investment income projected to begin being used in the early 2020s. Over the long term, the base CPP will remain primarily funded from contributions, with roughly 65% of total revenues coming from contributions and 35% from investment returns.

Consistent with the legislative requirement, the CPP enhancement will be fully funded. This will have the effect of ensuring that each generation's contributions, and the associated investment returns, are sufficient to pay for their benefits. Full funding has the effect of equalizing returns on contributions to the CPP enhancement across generations.

Unlike the base CPP, the CPP enhancement will rely more heavily on investment income rather than contributions to pay for benefits. Due to the full funding requirement, the CPP enhancement will accumulate assets quickly in the first decades of the plan and will begin to draw on investment returns to pay for benefits beginning in the 2050s. Over the long term, roughly 70% of total income is expected to come from investment returns.

While the CPP enhancement will be more resilient to demographic pressures, it will be more exposed to market volatility. Assets associated with the CPP enhancement are also projected to build up more quickly.

As a result, the framework for the financial sustainability of the CPP enhancement should reflect these differences in financing with the base CPP.

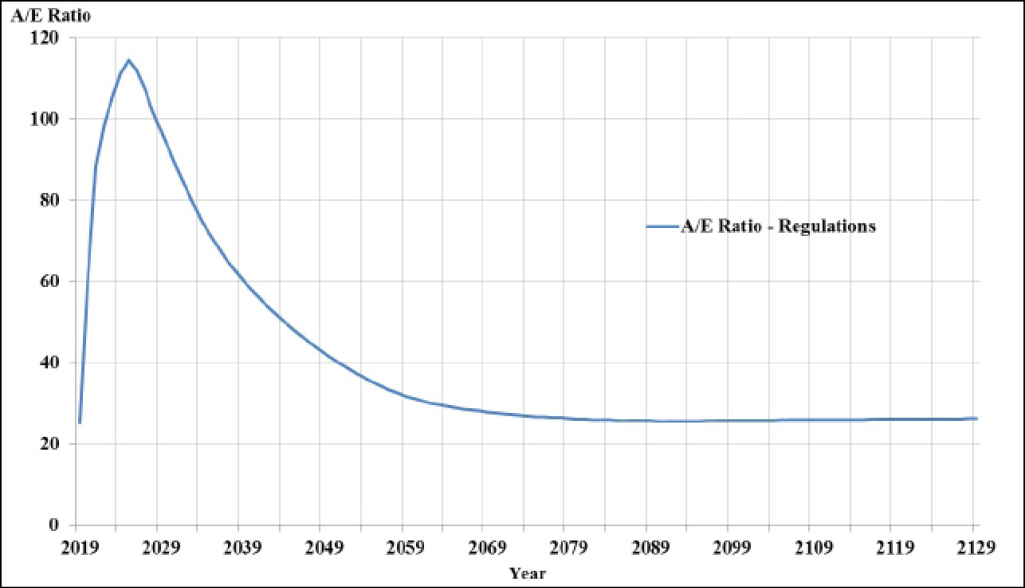

Chart 1: Asset-to-expenditure ratio — CPP enhancement under the minimum contribution rates

Source: Office of the Chief Actuary

Chart 1: Text version

A line graph showing the projected asset-to-expenditure ratio for the CPP enhancement over time using the minimum contribution rates. The X-axis shows the year beginning with 2019 and ending with 2129. The Y-axis shows the asset-to-expenditure ratio on a scale from 0 to 120. Data provided in table below.

| Year | 2019 | 2029 | 2039 | 2049 | 2059 | 2069 | 2079 | 2089 | 2099 | 2109 | 2119 | 2129 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A/E Ratio | 25.2 | 97.0 | 60.5 | 42.4 | 31.9 | 27.9 | 26.3 | 25.7 | 25.7 | 26.0 | 26.1 | 26.2 |

Objective

The objectives of these regulations are to

- establish the methodology for the actuarial calculation of the minimum contribution rates for the CPP enhancement;

- determine the acceptable range for these minimum contribution rates vis-à-vis the legislated rates over which the CPP enhancement would be considered to be in a sustainable position over the long term; and

- designate the automatic adjustments that would change benefits and contribution rates to bring the CPP enhancement back to a sustainable position, in the event that minimum contribution rates fall outside their sustainable range and ministers of finance cannot reach a consensus on changes.

These regulations ensure that the enhanced portion of the plan is appropriately funded over time while respecting intergenerational equity, consistent with the full funding principle underpinning the CPP enhancement.

Description

These regulations were developed to ensure that the enhanced portion of the plan is appropriately funded over time while respecting the fundamental differences between the base CPP and the CPP enhancement:

- the base CPP is a mature plan while the CPP enhancement will not mature for decades (as shown in Chart 1); and

- the financing approaches, as noted, are different, with the base CPP being mainly a pay-as-you-go plan while the CPP enhancement is fully funded and more reliant on investment income for revenues.

The design of these regulations takes into account these differences while meeting the objectives outlined above.

Calculation of Contribution Rates Regulations, 2021

These Regulations repeal the Calculation of Contribution Rates Regulations, 2007 and replace them with the Calculation of Contribution Rates Regulations, 2021, which set out the methodology for the actuarial calculation of the minimum contribution rates for both the base CPP and the CPP enhancement. The calculation of the base CPP minimum contribution rates will continue to follow the rules currently in place under the Calculation of Contribution Rates Regulations, 2007.

For the calculation of the additional minimum contribution rates (i.e. the minimum contribution rates for the enhancement), new rules are established by the Regulations. The amendments to the legislation in 2016 require that the CPP enhancement be financed through contribution rates that

- result in projected contributions and associated investment income sufficient to fully pay projected expenditures over the foreseeable future; and

- are the lowest constant rates that can be maintained over the foreseeable future.

Essentially, CPP legislation requires that the CPP enhancement maintain a fully funded position considering multiple generations of participants (sufficiency) while maintaining stable contribution rates over the long term (stability).

In order to satisfy these two conditions, the Regulations require that the Chief Actuary of Canada calculate the CPP enhancement minimum contribution rates such that for

- sufficiency, at the valuation date, assets are at least 100% of liabilities, on an open group basis; footnote 3 and

- stability, the projected asset-to-expenditure ratio is not lower in the 60th year after the end of the review period than in the 50th year after the end of the review period, with the added caveat that this 10-year stabilization period cannot start before year 2088. footnote 4

The stabilization years have been chosen to balance the following objectives:

- the stabilization years should be far enough in the future as to not interfere with the natural decrease in the asset-to-expenditure ratio resulting from the maturation of the plan;

- the stabilization years should not be too far into the future in order to minimize the uncertainty related to projections; and

- the "time gap" between the first and second stabilization years should be minimized, while ensuring the stabilization of the asset-to-expenditure ratio, to minimize uncertainty related to projections.

Based on simulations conducted by the Office of the Chief Actuary, in terms of the first two objectives, choosing to start the stabilization period earlier than 2088 would result in increasing asset-to-expenditure ratios over time, meaning the eventual overfunding of the CPP enhancement. Conversely, starting the stabilization period later than 2088 would not result in improved stability of the asset-to-expenditure ratio. In terms of the third objective, choosing more than 10 years between stabilization years would result in essentially the same minimum contribution rates and asset-to-expenditure ratios.

Additional Canada Pension Plan Sustainability Regulations

In addition, new regulations, the Additional Canada Pension Plan Sustainability Regulations, address two policy questions regarding the sustainability of the CPP enhancement:

- By how much, and for how long, can the minimum contribution rates deviate from the legislated contribution rates before action is required?

- If the minimum contribution rates deviate from the legislated rates by too much and/or for too long, and ministers of finance do not reach agreement on whether or how to adjust plan parameters, what happens?

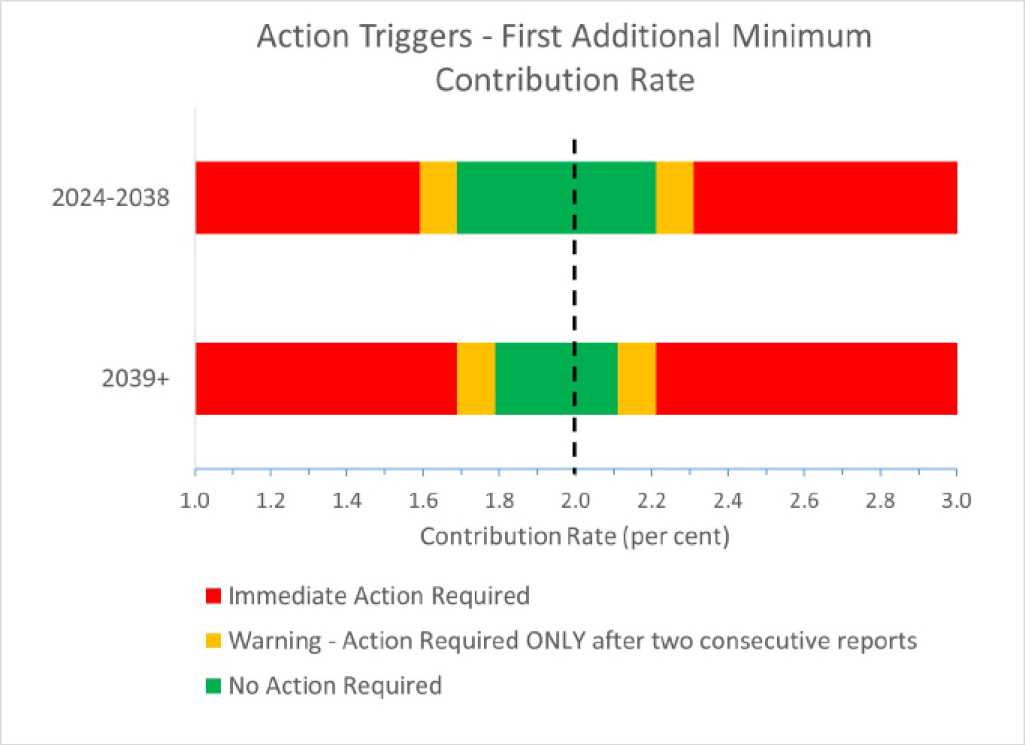

With regard to the first question, these Regulations allow for significant leeway in fluctuations of the minimum contribution rates before action is required, as illustrated by Chart 2 below, which shows the action ranges of the first additional minimum contribution rate categorized according to whether no action is required (green zone), action is required in the case of a warning (yellow zone) and immediate action is required (red zone). The application for the second additional minimum contribution rate would be similar except the ranges would be four times greater. footnote 5

Of note, the ranges differ in the early years of the plan and the later years. Further, these ranges are anchored to the current legislated rate of 2%; if the legislated rates are changed, the ranges would shift accordingly.

Chart 2: Action triggers — First additional minimum contribution rate

Chart 2: Text version

A bar graph showing the action triggers for the first additional minimum contribution rates. The top bar graph shows the action triggers for the first additional minimum contribution rates for years 2024 to 2038. The second bar graph shows the action triggers for the first additional minimum contribution rate for years 2039 and thereafter. The X-axis provides a scale of the first additional minimum contribution rates from 1.0% to 3.0%. The bar graphs provide three colour zones: a green no action zone; a yellow zone where action is required only after two consecutive reports; and a red immediate action required zone. Data provided in table below.

| Range | Requirement of Action | FAMCR (%) |

|---|---|---|

| Red | Immediate action | 1.00 to 1.59 and 2.31 to 3.00 |

| Yellow | Action required after 2 reports | 1.60 to 1.69 and 2.21 to 2.30 |

| Green | No action required | 1.70 to 2.20 |

| Range | Requirement of Action | FAMCR (%) |

|---|---|---|

| Red | Immediate action | 1.00 to 1.69 and 2.21 to 3.00 |

| Yellow | Action required after 2 reports | 1.70 to 1.79 and 2.11 to 2.20 |

| Green | No action required | 1.80 to 2.10 |

Beyond 2039, if the first additional minimum contribution rate is calculated by the Chief Actuary to be 31 basis points below the legislated rate, or 21 basis points above the legislated rate, action is required immediately (red zone). Alternatively, if the first additional minimum contribution rate is calculated to be between 21 and 30 basis points below the legislated rate, or between 11 and 20 basis points above the legislated rate, for two consecutive triennial reviews, action is also required (yellow zone).

As can be seen, there is greater tolerance for deviations as the plan is maturing. Before 2039, immediate action is required if the first additional minimum contribution rate is calculated by the Chief Actuary to be 41 basis points below the legislated rate, or 31 basis points above the legislated rate. This is a consequence of a wider range where no action is required (green zone).

The year 2039 was chosen because it is projected to be the first year when investment income and contributions are equal. After 2039, investment income is projected to become the main source of revenues for the CPP enhancement and its volatility will have an increasingly important impact on the financial stability of the plan.

Tables 1A and 1B below show the ranges for the additional minimum contribution rates (AMCRs) relative to current legislated rates categorized by requirement of action (assuming the AMCRs are rounded to four decimals).

| Range | Requirement of action | FAMCR table 1 note 1 (%) | Difference table 1 note 2 2.0% – FAMCR (bps table 1 note 3 ) |

SAMCR table 1 note 4 (%) | Difference 8.0% – SAMCR (bps) |

|---|---|---|---|---|---|

| A | Immediate action required | ≤ 1.59 | 41 or higher | ≤ 6.36 | 164 or higher |

| B | Warning — Action required ONLY after being in this range for TWO consecutive reports | [1.60 to 1.69] | 31 to 40 | [6.40 to 6.76] | 124 to 160 |

| C | No Action Required | [1.70 to 2.20] | −20 to 30 | [6.80 to 8.80] | −80 to 120 |

| D | Warning — Action required ONLY after being in this range for TWO consecutive reports | [2.21 to 2.30] | −30 to −21 | [8.84 to 9.20] | −120 to −84 |

| E | Immediate action required | ≥ 2.31 | −31 or lower | ≥ 9.24 | −124 or lower |

Table 1 note(s)

|

|||||

| Range |

Requirement of action |

FAMCR table 2 note 1 (%) |

Difference table 2 note 2 |

SAMCR table 2 note 4 (%) |

Difference |

|---|---|---|---|---|---|

| A | Immediate action required | ≤ 1.69 | 31 or higher | ≤ 6.76 | 124 or higher |

| B | Warning — Action required ONLY after being in this range for TWO consecutive reports | [1.70 to 1.79] | 21 to 30 | [6.80 to 7.16] | 84 to 120 |

| C | No action required | [1.80 to 2.10] | −10 to 20 | [7.20 to 8.40] | −40 to 80 |

| D | Warning — Action required ONLY after being in this range for TWO consecutive reports | [2.11 to 2.20] | −20 to −11 | [8.44 to 8.80] | −80 to −44 |

| E | Immediate action required | ≥ 2.21 | −21 or lower | ≥ 8.84 | 84 or lower |

Table 2 note(s)

|

|||||

Allowing for even greater tolerance for deviations in the early years of the plan minimizes the frequency and magnitude of required changes over the first two decades of the CPP enhancement while assets accumulate and benefit expenditures are modest. It is very unlikely that the investment experience during the period 2024 to 2038 would cause the first additional minimum contribution rate to fall below 1.7% or rise above 2.2%. For example, annual nominal returns lower than −17.8% or higher than 24.8% during each year of the inter-valuation period 2031 to 2033 would cause the first additional minimum contribution rate to rise above 2.2% or fall below 1.7%, respectively. The probability of such returns occurring is almost zero.

With regard to the second question, the amendments to the legislation in 2016 set out that, if the CPP enhancement is calculated by the Chief Actuary to be in an unsustainable position, it is the responsibility of federal and provincial ministers of finance to agree on adjustments to benefits and/or contributions to return the plan to a sustainable position. Alternatively, ministers of finance may agree to not take any action.

If ministers of finance do not reach an agreement to modify (or not modify) plan parameters, automatic adjustments, as set out in the Regulations, will apply. Similar provisions exist for the base CPP in legislation that set out a combination of benefit reductions and contribution rate increases.

The Regulations will, as a first step, reverse any previous actions taken as a result of the operation of these Regulations in an opposite direction (e.g. if the plan was now in a deficit situation, prior increases to benefits as a result of the application of these Regulations would be reversed). In the event that reversing prior actions is insufficient to restore the plan to a sustainable position, these Regulations set out a different approach depending on whether the plan is in a surplus position (i.e. minimum contribution rates are below the legislated rates) or a deficit position (i.e. minimum contribution rates are above the legislated rates):

- if the CPP enhancement is in a surplus position, these Regulations would increase benefits for both current and future beneficiaries; and

- if the CPP enhancement is in a deficit position, adjustments would be shared sequentially between contributors, employers and beneficiaries by

- first reducing the growth in benefits for both current and future beneficiaries within a certain limit, and

- if such reduction is insufficient to restore the plan to a sustainable position, then contribution rates would be increased.

Moreover, the automatic adjustments would restore the plan to a different target value depending on whether the plan is in a surplus or deficit position. If the plan is in a deficit position, the automatic adjustments would aim to return the minimum contribution rates to the legislated rates. However, if the plan is in a surplus position, the automatic adjustments would aim to return the minimum contribution rates to target values that are lower than the legislated rates in order to minimize the risk of future corrections. The chosen values (10 and 40 basis points) represent the halfway point within the green zone (zone C) that is below the legislated contribution rates for 2039 and beyond.

The Regulations will adjust benefits by modifying the indexation for current beneficiaries and applying a benefit multiplier to future benefits. The benefit multiplier is a factor applied to future benefits that would ensure that a future beneficiary would see an equivalent percentage increase/decrease in benefits relative to the percentage increase/decrease in benefits for current beneficiaries.

The Regulations limit the maximum reduction in indexation when the plan is in a deficit position to 60% of the consumer price index (CPI), which, in turn, limits the maximum value for the benefit multiplier by applying the same percentage decrease to benefit amounts for current and future beneficiaries. That being said, a reduction in indexation only affects current beneficiaries and, as a result, will always have a lesser total impact than the benefit multiplier, which impacts a much larger group (current and future contributors).

The following tables provide an illustrative example of the application of the Additional Canada Pension Plan Sustainability Regulations. Table 2 shows a scenario where, after the 2046 – 2048 review period, the application of the Regulations results in the indexation of benefits in pay by 60% of CPI over the six years following the end of the review period (i.e. from 2049 to 2054 inclusively) and in the application of benefit multipliers for new benefits. Assuming that the inflation rate is 2% per year, at the end of the six-year adjusted indexation period in 2054, benefits in pay will be equal to 95% of what their value would have been with no adjustment to indexation. After 2054, regular indexation (at 2%) resumes, so that adjusted benefits remain equal to 95% of their unadjusted amounts.

Table 2 shows the impact on a typical beneficiary who is being paid a monthly retirement pension of $1,000 starting January 1, 2048.

| Year | Original benefit (January 1) | Adjusted benefit (January 1) | Ratio of adjusted to original benefit (rounded to two decimals) | ||

|---|---|---|---|---|---|

| Indexation | Amount ($) | Indexation | Amount ($) | ||

| 2048 | 1.02 | 1,000 | 1.020 | 1,000 | 1.00 |

| 2049 | 1.02 | 1,020 | 1.012 | 1,012 | 0.99 |

| 2050 | 1.02 | 1,040 | 1.012 | 1,024 | 0.98 |

| 2051 | 1.02 | 1,061 | 1.012 | 1,036 | 0.98 |

| 2052 | 1.02 | 1,082 | 1.012 | 1,049 | 0.97 |

| 2053 | 1.02 | 1,104 | 1.012 | 1,061 | 0.96 |

| 2054 | 1.02 | 1,126 | 1.012 | 1,074 | 0.95 |

| 2055 | 1.02 | 1,149 | 1.020 | 1,096 | 0.95 |

Table 3 below shows the scenario of a new beneficiary who starts her retirement benefit on January 1, 2050 (within the adjustment indexation period), with an original initial monthly benefit amount of $1,000. The combined application of a benefit multiplier and reduced indexation for this new beneficiary is shown. Since she starts her benefit in 2050, her benefit multiplier is 0.984, and her original benefit of $1,000 will be adjusted to $984. Her benefit will then be indexed going forward according to the adjusted indexation of 1.012 until 2054, with reversion to regular indexation from 2055 onward.

| Year | Original benefit (January 1) | Adjusted benefit (January 1) | Ratio of adjusted to original benefit (rounded to two decimals) | |||

|---|---|---|---|---|---|---|

| Indexation | Amount ($) | Benefit adjustment factor | Indexation | Amount ($) | ||

| 2050 | N/A | 1,000 | 0.984 | N/A | 984 | 0.98 |

| 2051 | 1.02 | 1,020 | N/A | 1.012 | 996 | 0.98 |

| 2052 | 1.02 | 1,040 | N/A | 1.012 | 1,008 | 0.97 |

| 2053 | 1.02 | 1,061 | N/A | 1.012 | 1,020 | 0.96 |

| 2054 | 1.02 | 1,082 | N/A | 1.012 | 1,032 | 0.95 |

| 2055 | 1.02 | 1,104 | N/A | 1.020 | 1,053 | 0.95 |

Finally, Table 4 shows the scenario of a future beneficiary who starts her retirement benefit on January 1, 2054, with an original benefit amount of $1,000. Her benefit multiplier is then 0.95 and her adjusted benefit would be $950. Her benefit will be indexed from 2055 onward with full indexation, and the ratio of her benefit to the unadjusted benefit will remain 0.95. All new beneficiaries after January 1, 2054, would likewise have a benefit multiplier of 0.95 applied to their benefits with full indexation applied thereafter.

| Year | Original benefit (January 1) | Adjusted benefit (January 1) | Ratio of adjusted to original benefit (rounded to two decimals) | |||

|---|---|---|---|---|---|---|

| Indexation | Amount ($) | Benefit adjustment factor | Indexation | Amount ($) | ||

| 2054 | N/A | 1,000 | 0.95 | N/A | 950 | 0.95 |

| 2055 | 1.02 | 1,020 | N/A | 1.02 | 969 | 0.95 |

| 2056 | 1.02 | 1,040 | N/A | 1.02 | 988 | 0.95 |

| 2057 | 1.02 | 1,061 | N/A | 1.02 | 1,008 | 0.95 |

| 2058 | 1.02 | 1,082 | N/A | 1.02 | 1,028 | 0.95 |

| 2059 | 1.02 | 1,104 | N/A | 1.02 | 1,049 | 0.95 |

Table 5 illustrates the impact at maturity (2075) on benefits and contributions of the application of the Regulations under different values of the first additional minimum contribution rate (FAMCR) and assuming a CPI of 2%, which translates into a maximum reduction in benefits for future and current beneficiaries of 5%. As can be seen, if the FAMCR is in the yellow zone (zone B), the burden of adjustment will fall mainly on benefit reductions. As the FAMCR increases, the burden of adjustment will shift towards contribution rate increases. In this scenario, the FAMCR required for a 50/50 share in benefit and contribution adjustments would be 2.3%.

Table 5: Benefit indexation reduced to no less than 60% of CPI (maximum benefit reduction of 5%)

Notes:

For zones A and C, the assumed FAMCR as at December 31, 2072, is 2%.

For zone B, the FAMCR as at December 31, 2072, is assumed to be in the B zone.

New FAMCR is calculated as at December 31, 2075.

Adjustments to benefits are assumed to take place starting in 2079 and reach their ultimate value in 2084.

| Action zone | First additional minimum contribution rate (FAMCRtable 6 note 1) | Shortfall addressed by benefit reductions (bpstable 6 note 2) | Shortfall addressed by benefit reductions (%) | Shortfall addressed by contribution increases (%) |

|---|---|---|---|---|

| A | 2.00 | N/A | N/A | N/A |

| 2.05 | ||||

| 2.10 | ||||

| B | 2.11 | 0.11 | 100 | 0 |

| 2.15 | 0.15 | 100 | 0 | |

| 2.20 | 0.15 | 75 | 25 | |

| C | 2.25 | 0.15 | 60 | 40 |

| 2.30 | 0.15 | 50 | 50 | |

| 2.35 | 0.15 | 43 | 57 | |

| 2.40 | 0.15 | 38 | 63 | |

| 2.45 | 0.15 | 33 | 67 | |

| 2.50 | 0.15 | 30 | 70 | |

Table 6 Notes

|

||||

The automatic adjustments, depending on whether the plan is in a surplus position ("benefits only") or a deficit position (sequential adjustment of benefits and contributions), strike a balance between being consistent with the principle of intergenerational equity, which was central to the design of the CPP enhancement, and ensuring that employers are not insulated from the burden of returning the plan to a sustainable position in a deficit situation.

Regulatory development

Consultation

Since 2017, provincial and territorial officials have been consulted extensively on the development of the regulations. Significant analysis and advice were also sought from the Office of the Chief Actuary during the policy development process. In addition, analysis and options related to the regulations were discussed at a seminar in July 2017 with some of Canada's leading pension actuaries. The basic design described in the regulations was validated by the pension actuaries invited to this seminar.

On October 22, 2018, the Office of the Chief Actuary released Actuarial Study No. 20 — Technical Paper on the Additional Canada Pension Plan Regulations, which provided technical analysis on the design and potential applications of the regulations. Overall, the feedback to Actuarial Study No. 20 was largely positive.

The proposed amendments were published in the Canada Gazette, Part I, on October 20, 2018, for a 30-day comment period; two written submissions were received from union stakeholders.

Union stakeholders raised some concerns about the proposed amendments. They noted that the CPP enhancement is sensitive to capital market fluctuations, which could translate into frequent adjustments to benefit levels, thereby eroding the CPP's defined benefit nature.

The regulations, however, include mechanisms to mitigate this risk. For one, federal and provincial ministers of finance retain full responsibility for plan changes. The automatic adjustments are triggered only if federal and provincial ministers fail to agree on the appropriate approach to take to bring the plan back to sustainability, thereby providing ample opportunity to consider the right balance between adjustments to benefits versus contributions. Moreover, the regulations set a wide band for the acceptable range for the minimum contribution rates with the express purpose of providing more stability for benefit and contribution levels, and would only result in plan changes if a negative (or positive) trend persists.

Union stakeholders also recommended that the automatic adjustments for the CPP enhancement be the same as those used in the base CPP, which would result in roughly equivalent adjustments to benefits in pay and contribution rate increases in the event of a deficit. However, the regulations were developed to ensure that the CPP enhancement is appropriately funded over time while respecting fundamental differences between the base CPP and the CPP enhancement.

In the base CPP, demographic factors, whose impacts are long-term and develop slowly over time, drive the sustainability position of that portion of the plan. Therefore, the acceptable range and the default adjustments for the base CPP are based on permanent increases in the contribution rate for current and future contributors and a permanent slowdown in the growth in benefits for individuals who were beneficiaries at the time the adjustments were made.

On the other hand, the sustainability position of the CPP enhancement is driven primarily by investment volatility. This means that even if short-term experience resulted in a deviation in the minimum contributory rates from legislated rates, the minimum contributory rates could still revert to the legislated rates without any adjustments being made. Therefore, the acceptable ranges and automatic adjustments for the CPP enhancement in the regulations aim at being default course corrections, which may not be necessarily permanent and could be reversed later on.

The approach in the regulations is consistent with the concept of intergenerational equity and ensures that plan members, whether they are current retirees, employees or employers, share in a relatively equal way the adjustments to the CPP enhancement.

Modern treaty obligations and Indigenous engagement and consultation

Indigenous peoples and the rights protected by section 35 of the Constitution Act, 1982, modern treaties and international human rights obligations are not impacted by the regulations.

Instrument choice

The legislation governing the CPP (the Canada Pension Plan or the Act) provides the framework for the regulations. The Act provides the federal Minister of Finance with the authority to make regulations and defines the framework for the three issues that need to be addressed through regulatory instruments:

- the methodology for the calculation of the additional minimum contributory rates;

- the acceptable ranges for the additional minimum contributory rates relative to the legislated rates; and

- the automatic adjustments in the event that the additional minimum contributory rates are outside their acceptable ranges and ministers of finance are unable to reach a consensus on a course of action.

Regulatory analysis

Benefits and costs

The Calculation of Contribution Rates Regulations, 2021 set out the methodology for the calculation of the additional minimum contribution rates. As a result, these Regulations have no cost impact. These Regulations provide the necessary framework for the Chief Actuary to measure whether the CPP enhancement is in a sustainable position and, therefore, provide a benefit to all members in terms of plan accountability.

In the likely event that the default provisions in the Additional Canada Pension Plan Sustainability Regulations are not triggered, these Regulations have no cost implications given that they would simply provide the acceptable ranges for the additional minimum contributory rates that define whether the CPP enhancement is in a sustainable position. That being said, all Canadian workers are likely to benefit from these Regulations, which aim to ensure that the CPP enhancement remains financially sustainable and to provide stability to the plan over the long term.

In the unlikely event that the default provisions in the Additional Canada Pension Plan Sustainability Regulations are triggered, the benefit or cost impact will depend on whether the CPP enhancement has been deemed to be in a surplus or a deficit position. If deemed to be in a surplus position, the increase in the growth of benefits would result in increased benefits for current and future beneficiaries. If deemed to be in a deficit position, the decrease in the growth in benefits would result in decreased benefits for current and future beneficiaries. If the decrease in the growth of benefits is insufficient to return the plan to sustainability, increases to the legislated contributory rates are possible. These contributory rate increases would have an impact on both current and future employees and employers. That being said, the goal of these default actions is to return the CPP enhancement to a sustainable position, which would benefit all members of the plan by ensuring that benefits are there for Canadian workers when needed.

Small business lens

The small business lens does not apply, as there are no associated impacts on businesses.

One-for-one rule

The one-for-one rule does not apply, as these regulations do not impose any new administrative burden on businesses.

Regulatory cooperation and alignment

These regulations are not related to a work plan or a commitment under a formal regulatory cooperation forum.

Strategic environmental assessment

In accordance with the Cabinet Directive on the Environmental Assessment of Policy, Plan and Program Proposals, a preliminary scan concluded that a strategic environmental assessment is not required.

Gender-based analysis plus

In the likely event that the default provisions outlined in the Additional Canada Pension Plan Sustainability Regulations are not triggered, no gender-based analysis plus (GBA+) impacts have been identified for this proposal.

That being said, in the unlikely event that the default provisions described in the Additional Canada Pension Plan Sustainability Regulations are triggered, these provisions are designed to ensure intergenerational fairness. That is, the default provisions triggered in the event that the plan is in a surplus or deficit position minimize intergenerational transfers (e.g. younger age cohorts subsidizing older age cohorts).

Benefit adjustments in the regulations are shared between current and future beneficiaries. For current beneficiaries, benefits are adjusted by modifying the cost-of-living adjustment (indexation) for a certain number of years. For future beneficiaries, benefits are adjusted by multiplying benefits coming into pay in the future by a factor called the "benefit multiplier." The value of the benefit multiplier depends on the year a benefit commences and is determined in such a way that the benefits of both current and future beneficiaries are affected to the same extent. This means that the same percentage increase/reduction in benefits is applied to benefits in pay (current beneficiaries) and benefits coming into pay in the future (future beneficiaries).

In terms of gender, geographic area, language, culture and income, the default provisions described in the Additional Canada Pension Plan Sustainability Regulations and the Calculation of Contribution Rates Regulations, 2021 have no identified impacts.

Implementation, compliance and enforcement, and service standards

Implementation

Pursuant to the legislation, and similar to other major changes to the CPP, the regulations require the formal consent of at least 7 of the provinces, representing at least two thirds of the population of the 10 provinces, in order to come into effect. The necessary formal consent from provinces has been obtained.

In the unlikely event that the automatic adjustments are triggered, Service Canada would adjust the growth rate of benefits in pay and future benefits in accordance with the parameters set out in the regulations. In addition, in the event of a deficit position, if contribution rate increases are required, the regulations will deem an increase of the contribution rates in Schedule 2 of the CPP legislation. The Canada Revenue Agency would administer the collection of CPP contributions in accordance with these deemed contribution rates.

Contact

Galen Countryman

Director General

Federal-Provincial Relations Division

Department of Finance

90 Elgin Street

Ottawa, Ontario

K1A 0G5

Email: galen.countryman@canada.ca